Articoli correlati a The Little Book That Still Beats the Market: Updated...

Le informazioni nella sezione "Riassunto" possono far riferimento a edizioni diverse di questo titolo.

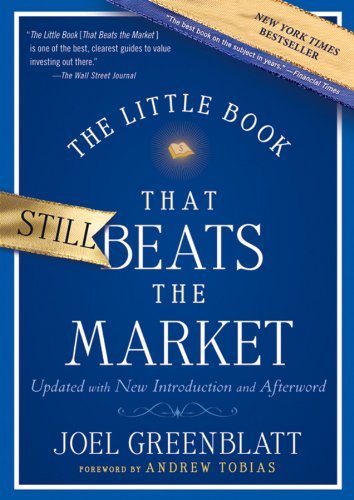

In a straightforward and accessible style, the book explores the basic principles of successful stock market investing and then reveals the author's time-tested formula that makes buying above-average companies at below-average prices automatic. Though the formula has been extensively tested and is a breakthrough in the academic and professional world, Greenblatt explains it using sixth-grade math, plain language, and humor. He shows how to use his method to beat both the market and professional managers by a wide margin. You'll also learn why success eludes almost all individual and professional investors, and why the formula will continue to work even after everyone "knows" it.

While the formula may be simple, understanding why the formula works is the true key to success for investors. The book will take readers on a step-by-step journey so that they can learn the principles of value investing in a way that will provide them with a long-term strategy that they can understand and stick with through both good and bad periods for the stock market.

As the Wall Street Journal stated about the original edition, "Mr. Greenblatt says his goal was to provide advice that, while sophisticated, could be understood and followed by his five children, ages six to fifteen. They are in luck. His Little Book is one of the best, clearest guides to value investing out there."

Le informazioni nella sezione "Su questo libro" possono far riferimento a edizioni diverse di questo titolo.

- EditoreJohn Wiley & Sons Inc

- Data di pubblicazione2010

- ISBN 10 0470624159

- ISBN 13 9780470624159

- RilegaturaCopertina rigida

- Numero di pagine183

- Valutazione libreria

Compra nuovo

Scopri di più su questo articolo

Spese di spedizione:

EUR 2,45

In U.S.A.

I migliori risultati di ricerca su AbeBooks

Little Book That Still Beats the Market

Descrizione libro Condizione: New. Codice articolo 7721640-n

The Little Book that Still Beats the Market: Your Safe Haven in Good Times or Bad, 2nd Edition Format: Hardcover

Descrizione libro Condizione: New. Brand New. Codice articolo 9780470624159

The Little Book That Still Beats the Market (Hardback or Cased Book)

Descrizione libro Hardback or Cased Book. Condizione: New. The Little Book That Still Beats the Market 0.56. Book. Codice articolo BBS-9780470624159

The Little Book That Still Beats the Market

Descrizione libro Condizione: New. Brand New! Not Overstocks or Low Quality Book Club Editions! Direct From the Publisher! We're not a giant, faceless warehouse organization! We're a small town bookstore that loves books and loves it's customers! Buy from Lakeside Books!. Codice articolo OTF-S-9780470624159

The Little Book That Still Beats the Market

Descrizione libro Hardcover. Condizione: new. Brand New Copy. Codice articolo BBB_new0470624159

The Little Book That Still Beats the Market

Descrizione libro Condizione: New. Codice articolo I-9780470624159

The Little Book That Still Beats the Market

Descrizione libro Hardcover. Condizione: new. Buy for Great customer experience. Codice articolo GoldenDragon0470624159

The Little Book That Still Beats the Market

Descrizione libro Hardcover. Condizione: New. Brand New!. Codice articolo 0470624159

The Little Book That Still Beats the Market

Descrizione libro Hardcover. Condizione: new. New. Fast Shipping and good customer service. Codice articolo Holz_New_0470624159

The Little Book That Still Beats the Market Little Books Big Profits 29

Descrizione libro HRD. Condizione: New. New Book. Shipped from UK. Established seller since 2000. Codice articolo IB-9780470624159